April 21, 2014

Written by Anneka Hoojisma

Preparation guide for grocery-chains

‘The online grocery shopping revolution’, is a preparation guide for grocery-chains in developed countries. It provides an outlook on the online grocery shopping market, e-grocery business models and how to prepare for the future.

The Rise of Online Grocery Shopping

Long lines, parking difficulties, crowded spaces, time-consuming, everyone knows the hassles of doing groceries at the store. These are therefore the top reasons for customers to do online grocery shopping (Reitsma, 2010). France, Switzerland, the United Kingdom and the United State are the biggest online grocery markets, with full range online retailers (Warschun, et al., 2012). The U.K. is the most developed market, with around 20% of the households doing online grocery shopping (IGD, 2013). Amazon is the leading company on the e-grocery market (Rudarakanchana, 2014). With the launch of AmazonFresh in San Francisco it is extending its online grocery shopping branch (Somerville, 2013), but encounters serious competition from established grocery stores like Wal-Mart in the U.S. and Tesco in the U.K. (Moskowitz, 2014).

Online grocery shopping is not something that can be offered by every grocery store around the corner, it requires high investments and logistics infrastructures (Hays, Keskinocak, López, 2004). Many supermarkets do see the customer need for convenience and therefore provide a more digital environment in store. Ranging from self-service check outs to smart shopping charts with real time feedback on promotions, recommended complementary products, sharing recipes and allowing to skip the checkout lane (van Ittersum, et al. 2013, Menezes & Usmani, 2010).

Although there is supply and demand for online grocery shopping, only 3,3% of global supermarkets sales of $ 60.000,- billion (FMI, 2012) is coming from e-grocery, expected 4% by the end of 2014 (Hamstra, 2013). Main reasons for the little use of online grocery shopping can be found in trust, costs and habits.

Trust

Especially for fresh products, customers lack trust in employees’ choice and product quality without seeing it themselves (Galant, López & Monroe, 2013, pp 23). “Putting trust into the hands of robots and employees who aren't necessarily as observant isn't easy. While Amazon does let you choose between "ripe" and "not ripe" avocados, everything else is a gamble.” (Vaknin, 2013).

Cost

Lower cost is one of the main reasons for customers to shop online. Due to the low margins on groceries, extra cost like; minimum amount of spending and delivery cost are charged for online grocery shopping. This has a negative influence on the customers’ decision to do online grocery shopping (Hays, Keskinocak, López, 2004).

Habit

Despite of the hassles experienced during grocery shopping in store, customers are used to this environment and it is part of their weekly routine and has become ritualised. Breaking with these habits, emotionally and physically, is something that takes time (Hartman Group, 2013). “Most customers were not ready to change their shopping habits, and even if they were, they preferred to buy from existing stores selling online, which they found familiar and more reliable.” (Galant, López & Monroe, 2013, pp 31).

The next generation, the Millennials, is ready! They are known as the first generation that is ‘always connected’ (PewResearchCenter, 2010, pp 1). “The high-tech, low-loyalty Millennial shoppers will be the primary spending demographic by 2020 and their desire for consuming empowerment and control will drive the redefinition of grocery retailing. It is disloyal demands and multichannel consuming behaviors of the Millinial shoppers that will likely fragment grocery retailing to the point that traditional supermarkets will become largely irrelevant.” (Farfar, 2014).

This paper is written to give an outlook on e-grocery, the different business models, the online purchase decision making process of customers and how grocery-chains can start preparing.

E-grocery

E-commerce is defined by the American Marketing Association as: “A term referring to a wide variety of Internet-based business models.” (n.d.), E-grocery is in this paper therefore defined as business models for online grocery shopping. There are several business models for e-grocery (Hartman Group, 2012, Hays, Keskinocak, & López, 2004, Warschun, et al. 2012), the four main ones are illustrated below.

Figure 1 – E-grocery business models Four business models for online grocery shopping.

- Store to home: this business model is for an existing grocery store. Customers can do online grocery shopping at the grocery stores’ webpage and the products will be home delivered. An example is Safeway that offers same day delivery by orders before 8:30 AM and 1-hour delivery windows.

- Click-and-collect: this business model is also for an existing grocery store. Customers can do online grocery shopping and collect the products at the nearest (or desired) location. En example is Walmart To Go. Walmart offers free in-store pickup. “According to its own study, approximately 55% of its surveyed customers would prefer to pick up groceries than have them delivered, primarily because it would allow them to pick up items they forgot. From Wal-Mart's perspective, this means that it's likely for many customers to enter the store.” (Moskowitz, 2014)

- Pure player delivery: this business model is for a pure online player. Customers can do online grocery shopping and get their groceries home delivered. An example of pure player delivery is AmazonFesh, when ordering before 10:00 a.m. groceries will arrive by dinner.

Drive-through/3rd part collaboration: This is a business model for an online player with a warehouse or that have a collaboration with other parties. Customers can do online grocery shopping and pick their groceries up from a drive-through at the warehouse or the 3rd party. An example of the collaboration is Giant Foods, grocery orders can be picked up at gas stations, without having to leave your car (Health, 2013).

Established grocery-chains most predominant advantages over online players “are massive resources, logistics infrastructures, and existing customer base, which lower the barrier to entry of traditional grocery stores“ (Hays, Keskinocak, López, 2004, pp 30).

Online purchase decision making process

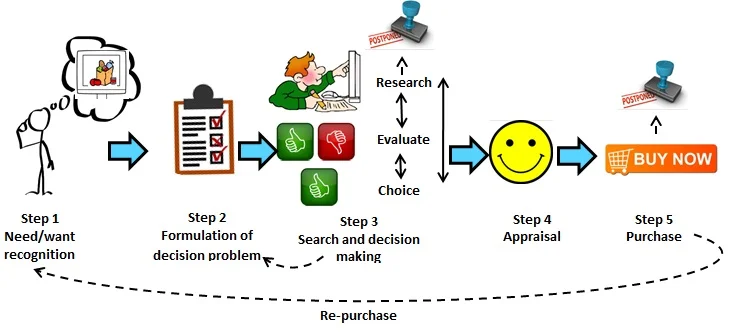

The four e-grocery business models all have one thing in common; the start online. Customers first need to find you online and make a decision if, from who and which groceries they want to shop online. To attract customers to your site and have them make a purchase, it is important to understand the online decision making process first (Karimi, Holland & Papamichail, 2013). “Knowing how customers use the online retail channel is fundamental to understanding the initial step in the customer value creation process” (Croome, Lawley & Sharma, 2010, pp 20). It is important to mention that decision making isn’t a logical problem-solving issue. Not all customers follow all the stages or follow them in this specific order first. This online purchasing decision making process is adapted from Karimi, Holland & Papamichail, 2013, see Figure 2.

Step 1 - The online decision making process starts with the recognition of the need or want. The customer is triggered by something and recognises that (s)he wants to do online grocery shopping.

Step 2 – The customer will formulate the decision problem . What is (s)he looking for and under what criteria. You are for example looking for red apples that will be delivered at your house tomorrow. Sometimes customers have little knowledge about the different criteria and need help in this stage.

Step 3 – the customer will search and make a decision. In this step the customer will do research on the alternatives, evaluate these and make a choice. The customer can skip steps in this process, decide to postpone the search and decision making or reformulate its decision problem.

Step 4 – the customer develops appraisal, by reviewing the process the customer will creating a feeling of certainty and control.

Step 5 – the customer purchases the groceries. This step can sometimes be quite complicated. If it is the case customers can still decide to postpone their purchase or decide to complete this stage through an offline channel.

After all steps of the one purchase decision making process comes the post-purchase behaviour. This can include; re-purchase, use of post-purchase services, spreading WOM, and so on (adapted from Karimi, Holland & Papamichail, 2013)

Figure 2 – Online Decision Making Process The five steps of the online decision making process. (adapted from Karimi, Holland & Papamichail, 2013)

Preparations for e-grocery

E-grocery is an upcoming market, where start-ups can quickly gain a lot of power when playing it right (Rudarakanchana, 2014). Therefore it is important that grocery stores start preparing for this now and start with the initial step in the customer value creation process. A multi-channel strategy is a good first step. At the moment online is mainly a complementary channel (Robinson, et al., 2007). But don’t underestimate this channel, research shows that web-influenced sales is five times larger than online sales by its own (O’Grady, 2014). It is therefore a perfect channel to create online brand awareness. In the long term brand awareness in lower price categories, like groceries, have a positive impact on purchases (Mintz, Currim, & Jeliazkov, 2013). It can also create a high level of trust in the brand, which is important when starting with online grocery sales (Croome, Lawley, & Sharma, 2010).

When starting an online grocery shopping webpage, it is important to consider the design throughout the whole page. This can have a large impact on customers purchase decision and drive sales if you do it right. From a brief review on case studies and previously done research’s several best practices have been detected to optimize your online grocery shopping site.

- Visibility of relevant content – Price and product attributes should be stated highly visible on the webpage. Customers, especially in a lower price category like groceries, can than quickly find a product that satisfies their needs (Mintz, Currim, & Jeliazkov, 2013).

- Clear purchasing process - a complex online purchasing process can cause the postponed of a purchase, as seen in the online decision making process. It is therefore important that the purchasing process is a clear process with a limited number of steps (Thirumalai & Sinha, 2011).

- Use categories – when categories are used for searching instead of search engines integrated on the webpage, customers are more likely to make impulse purchased and this can drive sales (User Interface Engeneering, 2002).

- Customization – customizations on webpages that assist the customer with making a choice and transactions, like personalized recommendations and saving of customer details, creates higher customer satisfaction (Thirumalai & Sinha, 2011).

- Customer reviews – Word-of-mouth (WOM) is acknowledged to be a powerful force in the customer marketplace (Sen & Lerman, 2007). Online customer reviews are ranked as “the top social media tool having a significant impact on buying behavior.” (Progressive Grocer, 2010).

Conclusion

E-grocery is an upcoming market. Although it is growing slowly, the coming of the Millennium generation can drastically change the landscape. It is important that grocery-chains are preparing for these changes, starting with a multi-channel approach. A lot of research has been conducted on the digitalisation of the in-store environment and the distribution channels. But the online environment of e-grocery should be investigated further. From a brief review on case studies and previously done research several best practices have been explained to optimize online grocery shopping site.

Reference list

AMA, n.d. ‘Resource Library - Dictionary’ Marketing Power [online]. Available at: <http://www.marketingpower.com/_layouts/dictionary.aspx?dLetter=E#e-commerce> [accessed 13-2-2014].

Croome, R, Lawley, M, & Sharma, B, 2010. 'Antecedents of Purchase in the Online Buying Process', Journal Of Internet Business, 8, pp. 1-40, Business Source Complete, EBSCOhost, viewed 15 February 2014.

Farfar, B., 2014. ‘Why Amazon Fresh Could Close Down Traditional Supermarket and Grocery Store Retail Chains - 2014 Food Retailing Trends and Predictions’ About.com. [online] 29 January. Available at: <http://retailindustry.about.com/b/2014/01/29/why-amazon-fresh-could-close-down-traditional-supermarket-and-grocery-store-retail-chains-2014-food-retailing-trends-and-predictions.htm> [Accessed 13-2-2014].

FMI, 2012. ‘Supermarket Facts – Industry Overview 2012’. FMI [online]. Available at: <https://www.fmi.org/research-resources/supermarket-facts> [Accessed 15-2-2014].

Galante, N., López, E.G. & Monroe, S., 2013. ‘The future of online grocery in Europe’ McKinsey & Company [online]. Available at: <http://www.mckinsey.com/~/media/McKinsey/dotcom/client_service/Retail/Articles/Perspectives%20book/05%20Online%20grocery.ashx> [Accessed 15-2-2014]

Hamstra, M., 2013. ‘2014 Prediction #3: Online Grocery Nears 4% Sales’ Supermarket News [online] 17 December. Available at:

<http://supermarketnews.com/online-retail/2014-prediction-3-online-grocery-nears-4-sales> [Accessed on 13-2-2014].

Hartman Group, 2013. ‘The Online Grocery Shopper 2013’ Hartman Group [online]. Available at: <http://www.hartman-group.com/downloads/online-grocery-shopper-report-product-sheet-2013.pdf> [Accessed on 14-2-2014].

Hartman Group, 2012. ‘The Online Grocery Opportunity’ Hartman Group [online]. Available at: <http://www.hartman-group.com/downloads/the-online-grocery-opportunity-2012.pdf> [Accessed on 14-2-2014].

Hays, T., Keskinocak, P. & López, V.M., 2004. ‘Strategies and challenges of internet grocery retailing logistics’ [online]. Available at: < http://www2.isye.gatech.edu/~pinar/egrocer.pdf> [Accessed at 14-2-2014].

Health, T. 2013. ‘Value Added: Grocery store pickups could be next business disruption’ The Washington Post [online] 7 October. Available at: <http://www.washingtonpost.com/business/economy/value-added-grocery-store-pickups-could-be-next-business-disruption/2013/10/06/bc86a856-2aa4-11e3-8ade-a1f23cda135e_story.html> [Accessed on 15-2-2014].

IGD, 2013. ‘Online grocery shoppers’ IGD [online] 20 March. Available at: <http://www.igd.com/our-expertise/Shopper-Insight/shopper-outlook/13229/Online-grocery-shoppers/> [Accessed at 15-2-2014].

Karimi, S, Holland, C, & Papamichail, N 2013. 'A purchase decision-making process model of online customers and its influential factor : a cross sector analysis', British Library EThOS, EBSCOhost, viewed 15 February 2014.

Menezes, R. & Usmani, Z., 2010. ‘Increasing Sales in Supermarkets via Real-Time information about

Customer’s Activities – The Swarm-Moves Simulation’ [e-journal]. Available at: <http://cs.fit.edu/~rmenezes/Publications/Entries/2010/9/6_All_Works_(Peer-Reviewed)_files/International%20Conference%20on%20Modeling%20Simulation%20and%20Visualization%20Methods%202006%20Usmani.pdf> [Accessed at 13-2-2014].

Mintz, O, Currim, I, & Jeliazkov, I 2013. 'Information processing pattern and propensity to buy: An investigation of online point-of-purchase behavior', Marketing Science, 32, 5, pp. 716-732, Scopus®, EBSCOhost, viewed 15 February 2014.

Moskowitz, D., 2014. ‘Walmart To Go vs. AmazonFresh: Who Deserves Your Grocery Order?’ The Motley Fool [online] 5 February. Available at: <http://www.fool.com/investing/general/2014/02/05/walmart-to-go-vs-amazonfresh-who-deserves-your-gro.aspx> [Accessed at 15-2-2014].

O’Grady, M., 2014. ‘Forrester Research Web-Influenced Retail Sales Forecast, 2013 To 2018 (EU-7)’ Forrester [online] 3 January. Available at: <http://www.forrester.com/Forrester+Research+WebInfluenced+Retail+Sales+Forecast+2013+To+2018+EU7/fulltext/-/E-RES111761> [Accessed at 14-2-2014].

PewResearchCenter, 2010. ‘Millenials- A Portrait of Generation next’ PewResearchCenter [online] February. Available at: <http://www.pewsocialtrends.org/files/2010/10/millennials-confident-connected-open-to-change.pdf > [Accessed at 15-2-2014].

Progressive Grocer, 2010. ‘Shoppers Would Rather Research Products Online: Study’ Progressive Grocer [online] 17 May. Available at: <http://www.progressivegrocer.com/top-stories/special-features/technology/id31025/shoppers-would-rather-research-products-online-study/> [Accessed at 14-2-2014].

Reitsma, R., 2010. ‘The Data Digest: US Online Grocery Shopping’ Forrester [online] 18 February. Available at: <http://blogs.forrester.com/reineke_reitsma/10-02-18-data_digest_us_online_grocery_shopping > [Accessed at 15-2-2014].

Robinson, H, et al., 2007. 'The role of situational variables in online grocery shopping in the UK', Marketing Review, 7, 1, pp. 89-106, Business Source Complete, EBSCOhost, viewed 15 February 2014.

Rudarakanchana, N., 2014. ‘The Future For E-Grocery: Amazon (AMZN) Fresh Retains Lead, But Startups Jump In’ International Business Times [online] 29 January. Available at: < http://www.ibtimes.com/future-e-grocery-amazon-amzn-fresh-retains-lead-startups-jump-1549969> [Accessed on 14-2-204]

Sen, S, & Lerman, D 2007. 'Why are you telling me this? An examination into negative customer reviews on the web', Journal Of Interactive Marketing, 21, 4, pp. 76-94, Scopus®, EBSCOhost, viewed 15 February 2014.

Sommerville, H., 2013. ‘AmazonFresh Launches In San Francisco But Faces Stiff Competition’ Siliconbeat [online] 11 December. Available at: < http://www.siliconbeat.com/2013/12/11/amazonfresh-launches-in-san-francisco-but-faces-stiff-competition/> [Accessed on 15-2-2014].

Thirumalai, S, & Sinha, K, 2011. 'Customization of the online purchase process in electronic retailing and customer satisfaction: An online field study', Journal Of Operations Management, 29, 5, pp. 477-487, Business Source Complete, EBSCOhost, viewed 15 February 2014.

User Interface Engeneering, 2002. ‘What Causes Customers to Buy on Impulse?’ User Interface Engeneering [online]. Available at: <http://www.uie.com/publications/whitepapers/ImpulseBuying.pdf> [Accessed on 13-2-2014].

Vaknin, S., 2013. ‘AmazonFresh vs. supermarket: A hands-on shopping test’ CNET [online] 17 December. Available at: <http://news.cnet.com/8301-1023_3-57615781-93/amazonfresh-vs-supermarket-a-hands-on-shopping-test/> [Accessed on 14-2-2014]

van Ittersum, K, et al. 2013, 'Smart Shopping Carts: How Real-Time Feedback Influences Spending', Journal Of Marketing, 77, 6, pp. 21-36, Business Source Complete, EBSCOhost, viewed 13 February 2014.

Warschun, M., et al. 2012. ‘A Fresh Look at Online Grocery’ ATKearny [online] March. Available at: < http://www.atkearney.com/paper/-/asset_publisher/dVxv4Hz2h8bS/content/a-fresh-look-at-online-grocery/10192> [Accessed at 13-2-2014].